Insights

The Journey to T+1: An Analysis of Key Impacts Across the Trade Process

Though the current requirement of two-day settlement has been around since 2017, the US Securities and Exchange Commission (SEC) has proposed to shorten the settlement cycle in the United States from two business days (T+2) to one (T+1).

December 2022

Chris Rowland

Senior Vice President, Head of Custody Product

We await regulatory confirmation from the SEC on the exact go-live timing of T+1, which was originally proposed for March 2024; however, the industry has requested for a more feasible transition around the Labor Day weekend in September 2024. This will require buy-side firms and their partners, including custodians, to significantly truncate a large number of processes across the typical trade cycle.

In this article, we identify six major challenges faced by institutions, the need to speed up their processes, recommended methods for achieving this and solutions available at State Street.

Though the current requirement of two-day settlement has been around since 2017, the US Securities and Exchange Commission (SEC) has proposed to shorten the settlement cycle in the United States from two business days (T+2) to one (T+1). We await regulatory confirmation from the SEC on the exact go-live timing of T+1, which was originally proposed for March 2024; however, the industry has requested for a more feasible transition around the Labor Day weekend in September 2024. This will require buy-side firms and their partners, including custodians, to significantly truncate a large number of processes across the typical trade cycle.

In this article, we identify six major challenges faced by institutions, the need to speed up their processes, recommended methods for achieving this and solutions available at State Street.

Allocations, affirmations and confirmations

Under the current (T+2) rules, affirmations can be completed by 11.30 a.m. ET the day after the trade date, giving buy-side organizations time to complete their allocations process and get all relevant data to their custodian, and giving the custodian time to match the affirmation to the client’s trade instruction.

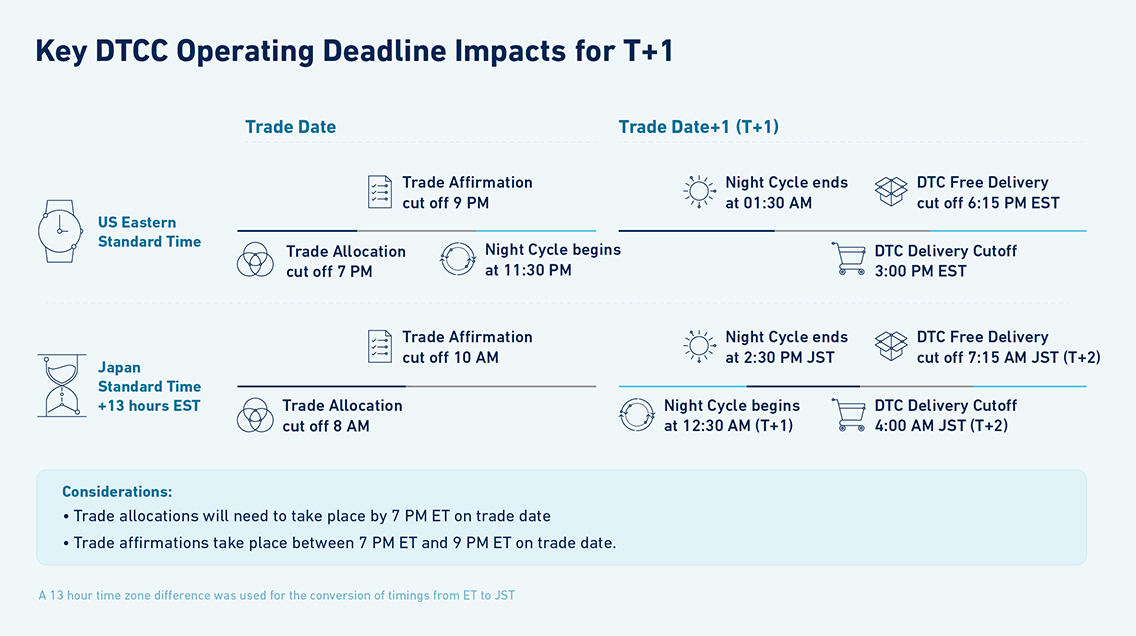

However, under T+1, trades will have to be affirmed by 9 p.m. on the trade date, meaning the trading entity must get the trade to their custodian in time for them to conduct the affirmation process and resend it to the Depository Trust and Clearing Corporation (DTCC).

Our analysis of DTCC data for June 2022 (the most recent available), shows that nearly 15 percent of trades were delivered the day after the trade date, indicating that these trades would have failed under the T+1 regime.

Furthermore, manual affirmations performed by the custodian require at least two hours, and sometimes even more. This indicates that even trades which were delivered on trade day might not have settled under the new regime, if they came through too close to the 9 p.m. deadline.

Automated affirmation tools, such as DTCC’s Central Trade Manager (CTM) or Match to Instruct (M2i) can make this process quicker as they deliver pre-matched information to the custodian.

Changing client trade instruction deadlines and problem solving

Identifying and eliminating problems that lead to changes in instructions, such as mismatches in the affirmation process (e.g., mismatched trade date, settlement date, executing broker and clearing broker details, place of settlement or net amount and breakdowns of relevant commission information), as early as possible in the process are key to minimizing trade failures caused by such problems, pushing trades beyond the settlement date.

We recommend DTCC’s CTM and M2i product, which are automated tools aimed at identifying or pre-empting these issues or other equivalent solutions.

To ensure that firms have enough time to process affirmations by 9 p.m. ET, the DTCC recommends that allocations in a T+1 regime be made by 7 p.m. ET on the day of the trade. It also offers materials designed to educate industry participants to promote intraday allocation processing.

Funding and liquidity considerations

Organizations should think about their Foreign Exchange (FX) funding needs in parallel with equity execution workflows. The timeframes laid out by DTCC for T+1 are US East Coast timeframes, which implies that overseas investors need to factor time zones into account when enacting their instructions for FX funding needs. As a result of these shortened settlement cycles, custodians will be changing deadlines for instructions, execution and settlement to meet the new T+1 settlement process.

It is imperative for organizations to review their current FX workflow, particularly the timing of when they are raising an FX order during the day. Some key questions to ask are:

- Communication method of the FX order (FAX, SWIFT, electronic, manual)

- Time and place considerations – when and from where is the order sent on T, T+1 or T+2?

- FX order management process – if it is centralized or decentralized, and can if it can be done from another location?

- Whether to keep balances in the USD account or raise FX for each trade

- Considerations about prefunding for US security activities

With the above in mind, trading platforms may need to be linked to align FX execution with trade settlement. We expect most FX transactions to be executed for same day value, and automation and straight through processing (STP) will be crucial for managers to meet the new tightened deadlines.

State Street Global Markets has automated solutions and products that can help managers automate their current execution processes by either integrating with an order management/trading system or setting up standing instructions to execute an FX.

Securities lending

When stocks are on loan from the trading organization, an additional element of complexity is added to the trading process. It is important to factor loan recall time into the cycle, along with the time taken to return any collateral held against the lending transaction.

A number of circumstances can affect recall times, such as timescales stipulated in the original lending agreement and liquidity of the loaned security. The reduced trade cycle of T+1 implies future securities lending deals should take these issues into account, with future trades in mind. Additionally, custodians and other trading services providers should be given more advanced information about trades involving loaned securities, wherever possible.

ETF activity

Shares in ETFs typically take longer to settle than most equities and other liquid securities as they involve the transfer of the underlying securities that make up the index, which the fund’s portfolio tracks. In some cases, these securities can be listed across different time zones and jurisdictions, generating similar added complexities to those in the FX section and requiring collateral to be posted a day earlier.

To help offset this additional complexity, DTCC is changing their systems to support ETF trades, including transforming its ETF application from a batch to real-time processing system. They are making functional changes to their Universal Trade Capture process and the primary and secondary ETF creation and redemption process which is detailed in its DTCC Functional Changes document.

Corporate actions and income distributions

It is anticipated that the corporate action cover/protect period will be calculated as expiration date plus one day in a T+1 settlement cycle, versus expiration plus two days in the current T+2 environment. Ex-date calculation for dividend processing will shift from one day prior to the record date in a T+2 settlement cycle to the same day as record date in a T+1 settlement cycle. DTCC is working with organized securities exchanges and the Financial Industry Regulatory Authority to determine when the ex-date shift will occur. This will require a quicker and more efficient distribution process and we recommend exploring technology solutions in this area.

While this change represents a significant shift in the trade lifecycle, the deadline for 2024 gives firms enough time to take into account key considerations and take appropriate steps now which will ensure that they are able to follow the new regime.